Your boss tells you to fix something. You struggle with it. You fix it. Your boss never follows up....

3 Ways Knowing Your Sales Conversion Rate Will Make You Money

I worked with a client once who told me he knew what his sales conversion rate was. He said that he got a notification on his phone every time he got a new lead, and that he closed most of the deals, so he chose some arbitrarily high number like 35%. Turns out, he was flat wrong.

In fact, I wished he were flat wrong. That would have been better than what actually happened, because his conversion rate started to tank dramatically after that. There were multiple reasons for that, all of which were discovered by understanding his data supporting his conversion rate calculation.

What is a sales conversion rate?

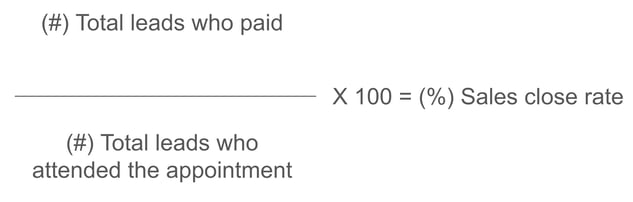

In plain English, a sales conversion rate is the percentage of all your customer leads that actually end up purchasing a product or service of yours. However, I prefer formulas, so:

Simple enough, right? Well, not so fast.

Those two simple inputs ...

- Total leads who purchased

- Total brand new leads

have a ton of activity and assumptions baked into them that have to be unpacked in order to understand the metric and how to use it in order to make decisions that make you money.

How does your sales conversion rate make you money?

1. Your sales conversion rate tells you how to hit your revenue goal

If you know your sales conversion rate, you can accurately determine how many leads you need to reach your revenue goals.

Now, if you pair that predictive capability with another metric, your lead acquisition cost, or the amount of money you need to spend to get one new lead, then you know exactly how much money you need to invest in your marketing or lead capture in order to get to your revenue goals.

Go fill in the blanks:

- How much revenue do you want? $___________ = Revenue Target

- How much, on average, does it cost to get one lead? $___________ = Lead Acquisition Cost (LAC)

- How much does your average customer pay you over their lifespan? $___________ = Customer Lifetime Value (LTV)

- At what rate do you convert brand-new leads to paying customers? ___________% = Sales Conversion Rate (CR)

Math:

- Revenue Target / LTV = # of customers you need

- # of customers you need / CR = # of leads you need

- # of leads you need X LAC = $ Investment Necessary

2. Your sales conversion rate tells you if you have a problem with your system

The predictive power of your sales conversion rate requires that you trust it. Meaning, your sales and marketing system is reliable enough to produce the same rate regardless of the circumstance.

That's one of the areas where my client went wrong. He made some changes in his system, and the result was a dramatic drop in his sales conversion rate (assuming it was correct to begin with, which it wasn't). So,

INDICATOR: If your sales conversion rate fluctuates a lot ...

DIAGNOSIS: Your sales and/or marketing system is broken somehow.

To pinpoint the issue exactly, we need some more metrics. Now, each sales system is built a little differently, so not all of this will apply to your situation. The following will describe a typical four-step sales process where you follow a process more of less like this:

- Receive a new lead

- A representative calls the lead and tries to set an appointment with the salesperson

- The salesperson meets with the lead and pitches your solution

- The lead signs a contract or pays for your product or service

Lead Set Rate

The lead set rate is the percentage of leads that actually set an appointment out of all the new leads you receive. It's very similar to the sales conversion rate, but it measures the first step of the process.

Lower-than-acceptable set rates indicate that something about the interaction between your representatives (setters) and your leads is not ideal. Listening in on setting calls will be the next debugging step.

Show Rate

The show rate is the percentage of leads who actually showed up to the appointment that you booked with them out of everyone who booked an appointment.

Lower-than-acceptable show rates indicate that something is wrong with the setting process (qualification parameters may be off), your appointment setting technology, or the offer itself. The next debugging steps would be to go through each of those possible three causes, hypothesize the cause, and experiment with potential solutions.

Sales Close Rate

Time to Close

- Time to first call: the time it takes for your first representative to make initial contact.

- Time to appointment: the time between when the appointment was set and when the appointment actually occurred

- Time to complete sale: The time between when your salesman first pitched your product or service and when the customer paid for the first time.

Generally speaking, better conversion rates are correlated with shorter times to close. It's good to monitor the shifts in these over time because it can tell you if something has changed significantly in your system that you need to debug.

Note

3. Benchmark your sales conversion rate against your peers

One of the most often overlooked benefits of KPIs, especially industry-standard ones like this, is benchmarking. If you can get an idea of what the sales conversion rate of your competitors is, you can know whether or not you are under- or over-performing in the market. It might give you an idea of what each other's competitive advantages are. Once you know that, you can double your marketing and sales pitches to focus on that.

Sales conversion rate benchmarks can be hard to get a hold of for small business owners. It's often a data set that only large companies can afford, but it's well worth the price if any of your known data marketplaces are offering it.

The Impact of Knowing Your Sales Conversion Rate

So, how did it fare with my client? It took some time to collect and clean the data (this is always the first problem that has to be solved), but once we had a decent trust in the data we realized virtually all of these metrics were not where they needed to be because the owner pulled out of the sales process before having properly trained the new sales team.

After hiring the right personnel for setting appointments (business development representatives) and then putting in place a proper sales training program, our KPIs returned to their previous levels and then stayed steady after we increased the volume of leads by 20x. The result was millions in additional revenue for the business.

That's the power of proper diagnostic tooling. Better diagnosis = better decisions = better sales conversion rates.

.jpg?width=50&name=PXL_20240317_144130012.PORTRAIT-EDIT%20(1).jpg)